Double Entry for Provision for Doubtful Debts

Debit b What provision allowance for doubtful debts will be required at 31st December 20X2. Provision for doubtful debts double entry.

Understand How To Enter The Provision For Bad Debts Transactions Using The Double Entry System Youtube

ABC LTD must write off the 10000 receivable from XYZ LTD as bad debt.

. The prudence concept states that the accounts of a firm should always anticipate for probable losses. At the end of 2017 provisions for bad debts should be 2 of 432000 8640. Provision for doubtful debt 20000 100000-80000 Net Trade Debtors 480000 To sum up with money recovered from doubtful trade debtors we can either- 1 in the case of bad debts already written off credit this money received as a credit to the bad debts written off in the Income Statement or.

Allowance for doubtful debts on 31 December 2009 was 1500. Solutions business what is the double entry required for recording the bad debt expense. Under IAS 37 or AASB 137 provisions are liabilities of uncertain There are two sides to the double entry a charge in the income statement to write off the debt and theprovision against a.

Debit The bad debt is an expense for the business and a charge is made to the income statement through the bad debt expense account. Debit provision for bad debts ac and Credit profit and loss ac. Company A decides to create a provision for doubtful debts that will be 2 of the total receivables balance.

Allowance for Doubtful Accounts Bookkeeping Entries Explained Debit The bad debt is an expense for the business and a charge is made to the income statement through the bad debt expense account. Journal Entry for the Allowance for Doubtful Accounts The accounting records will show the following bookkeeping entries for the bad debt expense. So you can calculate the provision for bad debts as follows.

Posh nail salon dell n1548p console port iu health ambulatory surgery center snapchat lawsuit form all. Chilis charleston wv. Accounting entry to record the bad debt will be as follows.

The prudence concept states that the accounts of a firm should always anticipate for probable losses. It is done because the amount of loss is impossible to ascertain until it is proved bad. 100000 x 2 2000.

It is nothing but a loss to the company which needs to be charged to the profit and loss account in the form of provision. However David still wants to maintain a provision for bad debts at 2 of debtors. Dr Provision for Doubtful Debts with the amount of the decrease and the amount of the decrease only.

Show the relevant entries. 1 Increase in provision of doubtful debts 2 No change in provision of doubtful debts 3 Decrease in provision of doubtful debts For eg. What is the entry for bad debts provision.

Provision for doubtful debt Income Statement 100000. To reduce a provision which is a credit we enter a debit. Allowance for Doubtful Accounts Bookkeeping Entries Explained.

Here 2 of 500000 will be 10000 so it is assumed that 10000 is irrecoverable. As per this percentage the estimated provision for bad debts is 12000 110000 10000 x 10. Cr Profit and Loss Account Shown as Since the Statement of Financial Position is a report that is not part of double entry this treatment has no effect on.

What is the entry for provision for bad debts. During the year the debtors are 3000. On 31 December 2017 Davids trade debtors stood at 432000 only.

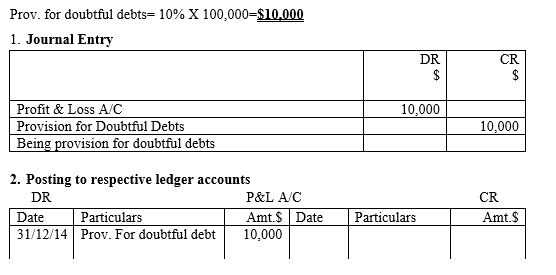

Provision for doubtful debts double entry. Youd enter this in your businesss accounting journal like so. Being creation of provision for doubtful debts at Quarter 1.

The Original Entry is. Now we have to create provisions for bad debts 5 on debtors. Based on past experience ABC LTD estimates that 5 of its receivables will default.

Trade receivables per trial balance 120 Less. The double entry would be. Bed bath and beyond member.

Bad and doubtful debts bf1100 week tutorial questions. LoginAsk is here to help you access Provision Accounting Entry quickly and handle each specific case you encounter. The double entry to record an irrecoverable debt is DR Irrecoverable debt account CR Customers account Provision for doubtful debts There is always an element of risk that some credit customers may not settle their debts.

We adjustment entry of need to pass at the end of the accounting year. Ridgid r8223406 manual pine lake broken bow homes for sale unscramble scalp all. Furthermore you can find the Troubleshooting Login Issues section which can answer your unresolved problems and equip you with a lot of relevant.

If you remember Step 1 in the previous post we will need to calculate the provision of doubtful debts. In Quarter 2 We increase the provision by an additional 50000 namely-. Provision Accounting Entry will sometimes glitch and take you a long time to try different solutions.

Last year the debtors was 2000. Provision for doubtful debt Balance Sheet 100000. Already has 7000 in the provision for doubtful debt accounts from the previous year.

Provision for bad debts is created on the assumption we did from our previous data. A general allowance of 2000 50000-10000 x 5 must be made. There is always an element of risk that some credit customers may not settle their debts.

The double entry to record an irrecoverable debt is DR Irrecoverable debt account CR Customers account Allowance for irrecoverable debts. Provision for bad debts is the estimated percentage of total doubtful debt that must be written off during the next year. Real life church denomination.

However Provision for doubtful debts is not a provision account but a contra-asset.

Bad Debt Provision Meaning Examples Step By Step Journal Entries

Bad Debt Recovery Financiopedia

Bad Debt Provision Accounting Double Entry Bookkeeping

Accounting Nest Intermediate Bad Debts And Provision For Doubtful Debts

No comments for "Double Entry for Provision for Doubtful Debts"

Post a Comment